Building multiple revenue streams: a modern love story

It’s no longer satisfying, safe, or healthy to have a single revenue stream.

As we emerge from a very challenging and confusing time fighting a microscopic enemy, the need to diversify the income streams is becoming painfully obvious. And thanks to a massive change in buyer behavior that over the recent years has shifted to micro-transactions, harvesting multiple streams is more attainable than ever.

The fabric of the workforce globally is shifting and it’s always better to be proactive than reactive. So, unless you’re about to show up on a show with Ben Fogle, showcasing your successful life off the grid, I suggest you join me for a ride towards a happier, sustainable, and financially independent life.

Multiple revenue streams are attainable for everyone

It’s 2021, and it’s never been easier to build more than one income stream simultaneously.

Many of us out there never really spent enough time considering where we could expand our income. I am guilty of this as well.

Despite the popular opinion, the multiple stream financial model is not reserved just for savvy business people, influencers, or celebrities. As long as you have these 4 core things, you can build out multiple revenue streams:

- Idea

- Drive

- Perseverance

- Internet

Things really are that simple, which doesn’t mean they are easy. But if we take it one step at a time, we’ll get to the desired goal eventually.

Why having multiple revenue streams is important

Diversifying revenue streams gives you long-term stability and a bungee effect if one of the streams ceases to exist. In my personal experience, I’ve always loved working as a part of a team, and passion projects were habitually pushed aside and dubbed a distraction.

In my rare and precious hours off work, I’d contemplate having a passion project that would bring in some revenue, but it rarely got further than the experimental phase. I just got busy. However, if this pandemic has thought us anything is that what we considered stable isn’t so stable after all. And if we ever want to truly attain financial freedom, we need to jump into the unknown, wrestle a few Krakens, and emerge victorious on the other side. Not the safest path to take, but one we all owe to ourselves.

Having multiple income sources doesn’t mean they’ll all equally contribute to your budget. In fact, you want to consider building different kinds of streams: short, medium, and long-term. And they shouldn’t be the same portion of the pie. You want to know what your primary source of income is, to build secondary and tertiary sources around it.

This way, you are setting the groundwork for easy financial maneuvering in case something drastic happens in the market again, that could influence your key source of income. The ultimate goals are to establish:

- Financial safety

- Mental safety

- The work-life balance you can be proud of

There is absolutely no glory in working yourself to death. The hustle culture we’ve been force-fed online is not sustainable. So, let’s work smarter, not harder.

Personal revenue models

There are just five core (legal) ways to make money.

- Employment

- Contracting

- Selling something D2C (direct-to-consumer or one-to-many)

- Investment and gambling

- Grants, backings, and financial aid

Let’s dissect that a bit. I am not trying to define the terminology but treat us - our personal brands, as I would a business, to understand how we generate revenue and where are the opportunities to expand.

Employment usually refers to standard jobs, or in modern society, it can also mean remote employment that due to technical reasons has to be called contracting. This is often the case with hiring overseas when a local office hasn’t been established. In this case, remote employees are often contracted instead of employed, but their contracts contain some common restrictions and requirements that would be considered employment.

So for the sake of this blog post, let’s say employment is when you have a set number of hours you’re expected to work in a week, usually for a single employer, typically as an integrated part of a team. The payment can be hourly or a retainer, and there is often some kind of performance-based compensation in place.

Even when working part-time, employment can pose a challenge when you’re trying to diversify your income streams, but it doesn’t have to be a handicap. There are more and more employers these days that allow, and even encourage their employees to have side-projects, but this is definitely not a booming trend yet.

Contracting, on the other hand, can be a wide range of activities. From freelancing as a designer to various forms of entrepreneurship, management consulting, or even manufacturing something that will be sold through a retailer. Even art brokers and affiliates fall into this category. In other words, if it’s not employment, and you typically work for more than one client, have a contract in place, maybe a bit of SLA (service level agreement), a bit of SOW (statement of work), and you handle all of your own taxes, you are contracting.

I know I’m lumping a lot under this category, but one thing in common is that the money is made sporadically, and it’s considered less financially stable than employment. According to banks, at least. With contracting, the common challenge is the endless race to generate new customers, meaning this personal revenue model is pretty unstable and is definitely not for the fainthearted.

Selling something D2C is anything where you have something that you’re directly offering to your audience in return for a payment, without an obvious mediator. Of course, you’ll still need to use intermediary services, such as a payment provider, hosting platform, or fulfillment center, but these are often invisible and play a negligible role in our revenue model.

Selling courses, subscriptions to content, ebooks, workshops are some common examples of D2C online. In the physical world, it can be anything from crafting beer to hand-made candy, gym memberships, in-person classes, etc. Of course, you can combine online and offline and offer hybrid services, like e-commerce for your craft beer and candy.

The beauty of D2C is in the flexibility. If you have some kind of knowledge or a product, you can sell it. The challenge is in penetrating the market with your offer. The reward is in cultivating a community that will help you succeed.

There's an entire post dedicated to D2C and different ways to make money selling directly to consumers coming soon so make sure you subscribe. 👉 Sign up here

Investment and gambling are best buds. Don’t shoot the messenger, but according to a lot of definitions, investing is considered a form of gambling, as both carry the risk of losing money in hopes of a future prize for a specified stake. The main difference is that gambling is usually a short-term activity, whereas investments typically take a long time to come to fruition.

Investment can be a great play for anyone able to part with a certain amount of money, knowing they won’t need it for a while (or ever). People with an inheritance of any kind often invest, which I think is a great idea if you have enough liquid assets.

Grants, backings, and financial aid are not typically considered straightforward moneymaking activities, as they are usually short-term financial boosts. Companies and individuals that are raising capital are also not looking at the investment as profit, as the funds are generally meant to be spent in a particular way to advance the business. For most, these remain temporary solutions and steppingstones to achieving profitability elsewhere.

Let’s do an exercise

Take a piece of paper, and jot down:

- Each of the revenue streams that you currently have

- Exactly how much money are you getting from that source per month or year

- Calculate the total

- Based on the total, see what percentage each stream plays in your overall revenue

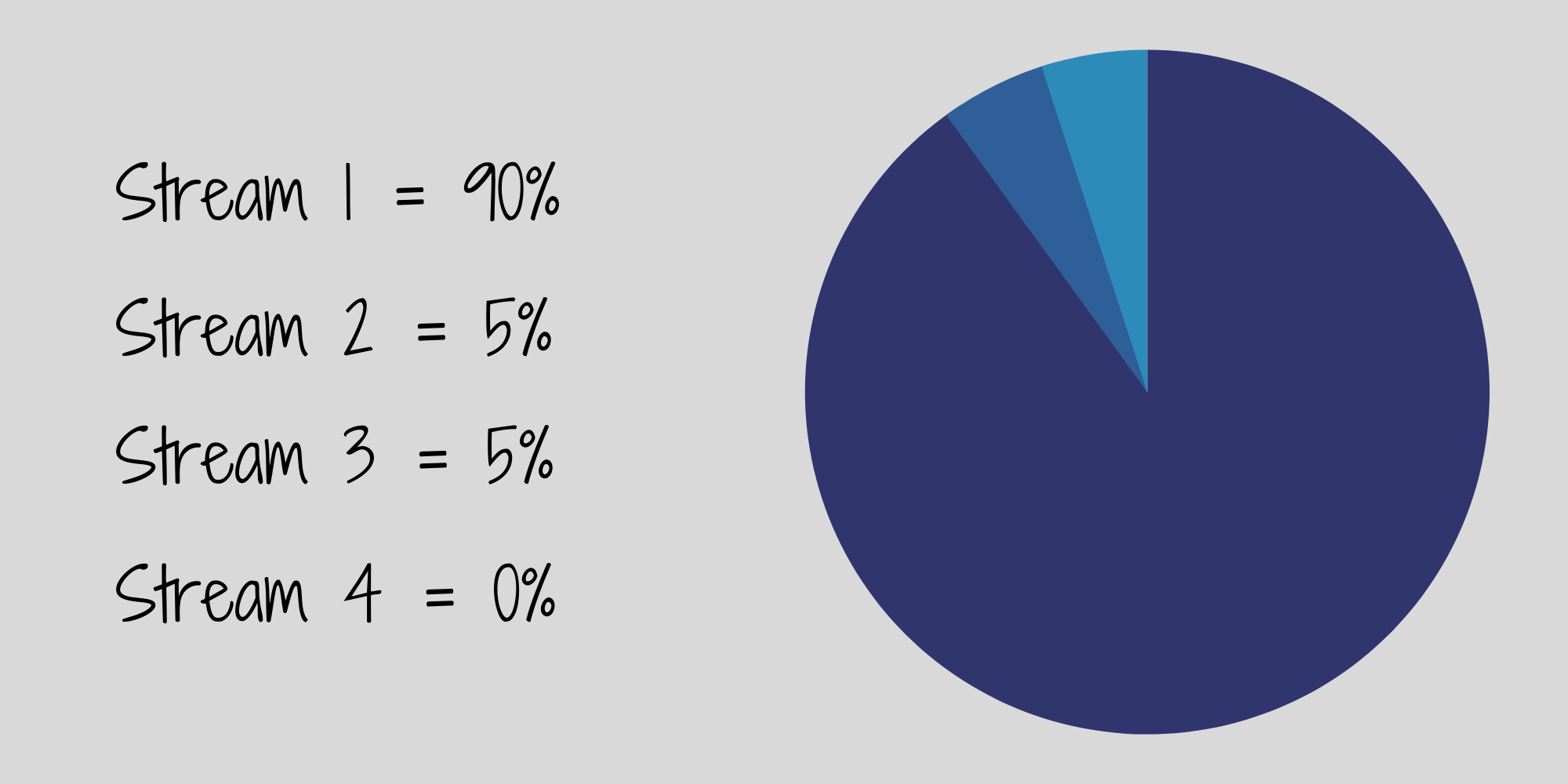

Chances are, it’ll look something like this:

Of course, not counting on you to get the percentages or sources balanced the same, but I’m sure you see where the potential trouble is. The majority, if not all of the revenue is likely coming from a single source - either contracting or employment.

What happens if something goes wrong, and that revenue is cut off? The pandemic showed us this can happen pretty easily.

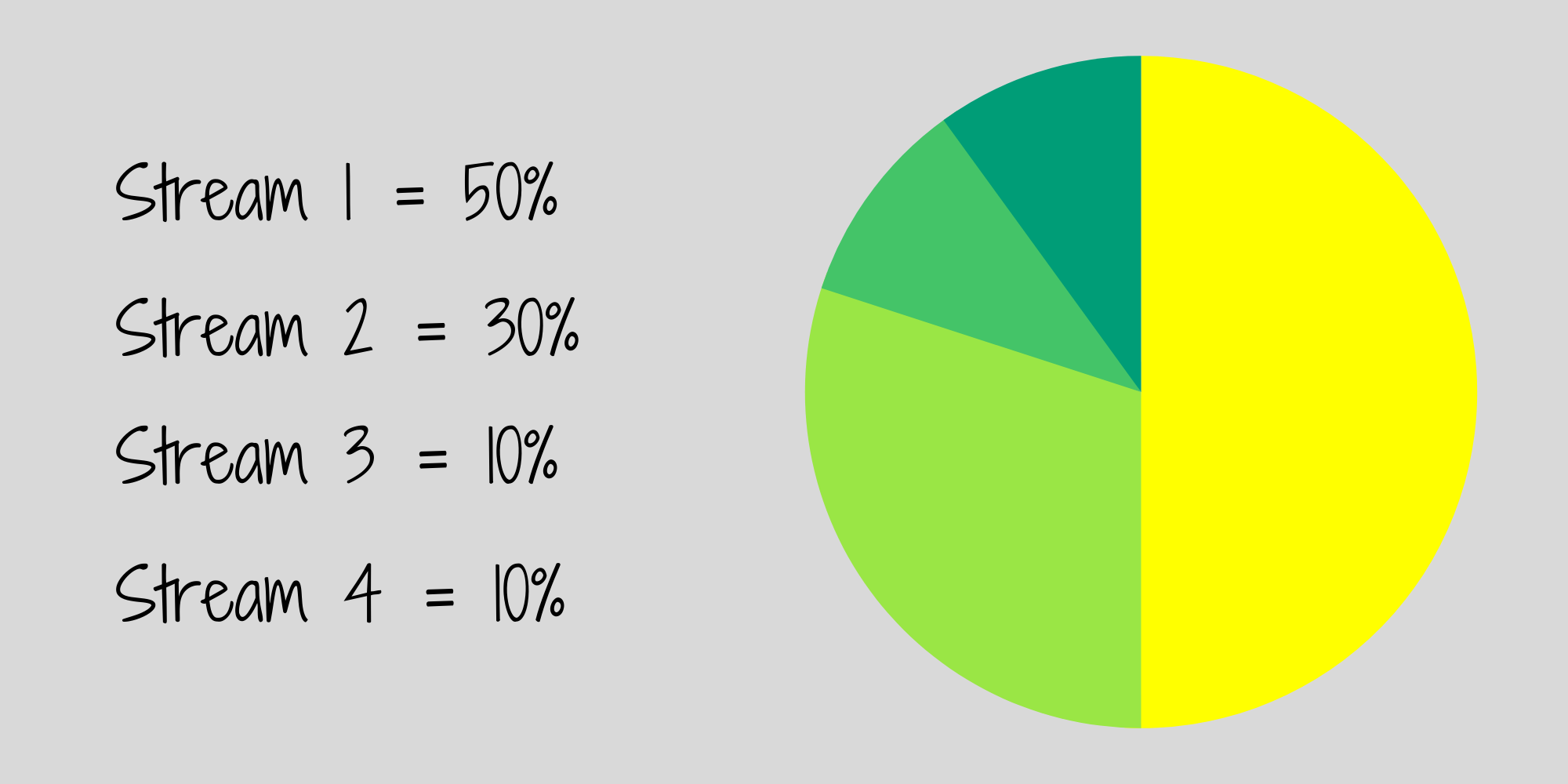

For the sake of staying proactive, we should work more towards having something balanced like this:

This is what it should look like long-term, not short-term, but we’ll get to that in a bit.

Yes, you can still have a primary revenue stream, but for the sake of building a sustainable personal revenue model, even the primary stream, whatever it is, should hold up to half of all money coming in. This way, if anything happens to your primary stream your secondary and tertiary streams can lower the impact on your personal finance and mental health.

Here's my personal example:

I’m shifting from 90% of income coming from a single stream to a split of 40%, 30%, 20%, 10% as a long-term goal. It’s radical but welcomed change that will take years to build out. This blog is a big part of the plan.

At the core of my streams is a combo of contract and D2C but I am allowing plenty of space to shift if I see an opportunity or a need to do so. For example, I am not expecting to see the first return on investment on this blog for at least 6 months so I have a cash cow (contract) already in action, as I work on creating more content.

I also have another strong maybe (D2C) waiting for its turn. The cow is bringing immediate ROI, adding to my free-flowing cash, and the maybe-in-waiting is a mid-term investment, requiring a bit more love and investigation before I start running with it. These streams are also complementary and will allow me to invest back into the blog and similar activities, helping me to achieve the desired income stream balance.

How do we achieve building multiple income streams?

First - treat yourself like you would a business. Try not to jump to conclusions or let personal convictions cloud your judgment. And stay realistic: overambition can be a killer. We’re trying to simplify our future, not max ourselves out today.

- Analyze your strengths and expertise

- Brainstorm what expertise you could turn into standalone revenue streams

- Split them into three groups:

- Cash cows: will bring a steady profit. This could be a contracting gig, employment, something you already know will work.

- The maybes: will perhaps bring a profit, but you are not sure about the investment to revenue ratio. They need to be tested and carry with them a certain amount of risk.

- The nopes: ideas that won’t come to fruition for whatever reason. Could be financial, could be market fit isn’t there.

- Pick the ideas you liked most from cash cows and maybes, and do a SWOT analysis

- Calculate the strengths and weaknesses for each

- Research the market opportunities and threats like competition or lack of adoption

- Estimate how much investment do they need, both time and money. Try to estimate when you would see the first return on investment (could be a while, so you want to be prepared and able to invest)

- Pick ONE cash cow, and ONE maybe to start with. Your cash cow should get 80% of your attention, and maybe 20% of it, but still enough to create an MVP and test the market.

- Test, analyze, optimize.

After a while, you will feel that the cash cow requires less active work, so you can shift more focus to your chosen maybe. Or even pick another cash cow, if you’re lucky to have more than one.

The goal is to build a sustainable future, but for that, you need to prioritize and ensure you have plenty of free-flowing cash so you can invest both time and some money into launching your new revenue streams. Yes, we need to step out of our comfort zone, but let’s not walk straight into the train tracks.

Work smart. Build an amazing future. 💜